Zimbabwe: The Apex Bank Lunches A New Gold-Backed Currency Called ZiG (Zimbabwean Gold)

Zimbabweans Have 21 Days To Convert Their Old Currency Into The New Currency Note, According To The Reserve Bank Of Zimbabwe.

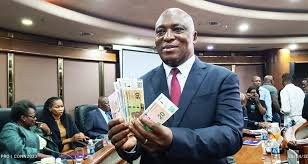

In it’s ambitious attempt to control Inflation the Zimbabwe’s central bank has launched a new currency backed by gold, as it fights to tackle sky-high inflation and stabilize the Zimbabwean long destabilized economy. The new currency, called “Zimbabwean Gold” (ZiG) which is backed by foreign currencies, gold and precious minerals, John Mushayavanhu, the Governor of Zimbabwe’s Reserve Bank, told reporters in the capital Harare on Friday.

Unveiling the new Currency notes, the Apex Bank Governor John Mushayavanhu said the ZiG would be structured, and set at a market-determined exchange rate. The ZiG would replace Zimbabwean dollar, the RTGS, that had lost three-quarters of its value so far this year. Annual inflation in March reached 55% – a seven-month high in an economy that has witnessed from crisis to crisis for the past 25 years.

On this note, Zimbabweans have 21 days to exchange old, inflation-hit notes for the new currency. However, the US dollar, which accounts for 85 percent of transactions already in the country, will remain legal tender therefor most people are likely to continue to chose the US dollars. The new currency, ZiG will come in denominations of between 1 and 200. While the coins will also be introduced to overcome the shortage of US Coins the Cent, which has seen people receiving their change with sweets and pencils.

Zimbabwean Reserve Bank Governor, John Mushayavanhu.

Furthermore the Zimbabwean Central Bank Governor Mr. Mushayavanhu said the new currency was being rolled out with immediate effect and banks must convert current Zimbabwe dollar balances to the new currency ZiG (Zimbabwean Gold) Committed to ensuring that the amount of local currency in circulation was backed by equivalent value in precious minerals – mainly gold – or foreign exchange, in order to prevent the currency losing value like its predecessors.

Mistrust of the central bank, has been existing since 2008, when the country printing Z$10tn notes as inflation had run out of hand. Then her own currency the Zimbabwean Dollars where abolished and for many years only used foreign banknotes such as the US dollar and the South African rand. In later part of 2016, the reserved Bank introduced a new currency called the bond note that was backed by the US dollar loan. Then the central bank governor then Mr. John Mangudya vowed it would remain on a par with the US dollar which he couldn’t realize and the bond note crashed as the government began printing excess money.

Additionally, the Reserve Bank Governor has promises that overprinting will not be repeated.

But public reaction on Friday to the latest currency reveal has been subdued. “We now end up in the same place where we started – where assurances are being given to the market that the government will live within its means,” economist Godfrey Kanyenze told the press. According to him “The political culture has not changed – the critical point is discipline on the part of the authorities.” This new currency announcement comes as the country is grappling with a serious drought, that has destroyed half of the country’s crop of the staple food.

Zimbabwean New Currency Note The “ZiG.”

Zimbabwean New Currency Note The “ZiG.”

On Thursday, The countries President, Emmerson Mnangagwahas who recently declared a national disaster to tackle the prolonged drought crisis. Went to inspected the central bank’s vaults as the Apex Bank Governor Mushayavanhu who appointed earlier this year declared hold 1.1 tones of solid gold in reserve and about another 1.5 tones more outside the country, with $100 million in cash and other precious minerals like diamonds which if converted into gold would be totaling about another 0.4 tones, he claimed.

In all the total reserves will value about $285 million, which Mushayavanhu declared which will “more than three times cover for the ZiG currency being issued”.

But in some quarters they doubted him. “We obviously need more,” said economist Prosper Chitambara, adding that other countries such as neighboring South Africa had much larger reserves. “The more the reserves, obviously, the more the confidence and the more your capacity to be able to defend your currency against any shocks.” The Apex bank assured it would adopt a tight monetary policy this time, linking money supply growth to growth in gold and foreign exchange reserves.

So far The Zimbabwean dollar has lost more than 75 percent of its value against the US dollars since the past years. Very worrisome on Friday, it was officially traded at around 30,000 against the US dollars and at 40,000 on the black market. The poor performance of the Zimbabwean Dollars heavily contributed to the high inflation rate, which after climbing well into the triple digits last year, was at 55 percent in March, according to official data. These issues has piled enormous pressure on 16 million Zimbabweans who are already struggling to contend with widespread poverty, severe drought and high unemployment.

www.oneinfoafrica.com